Insurance Long Term Care

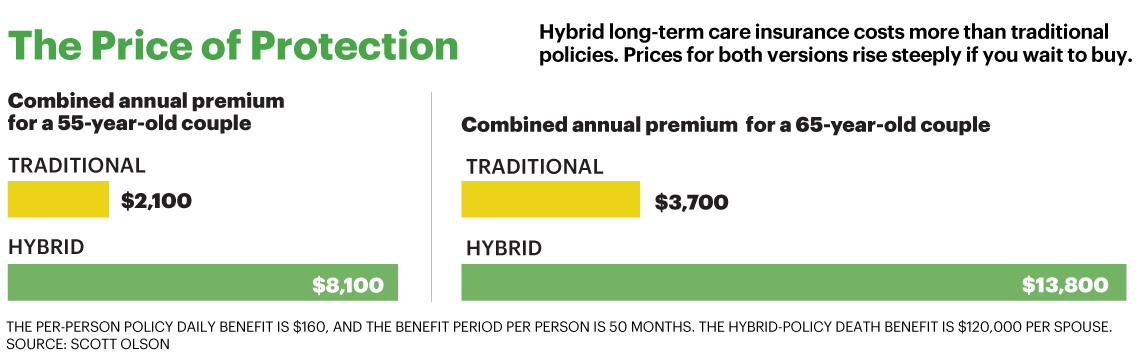

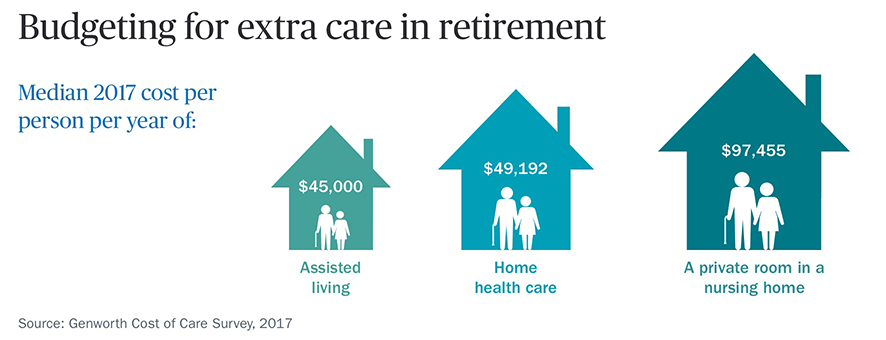

Typical terms today include a daily benefit of 160 for nursing home coverage a waiting period of about three months before insurance kicks in and a maximum of three years worth of coverage.

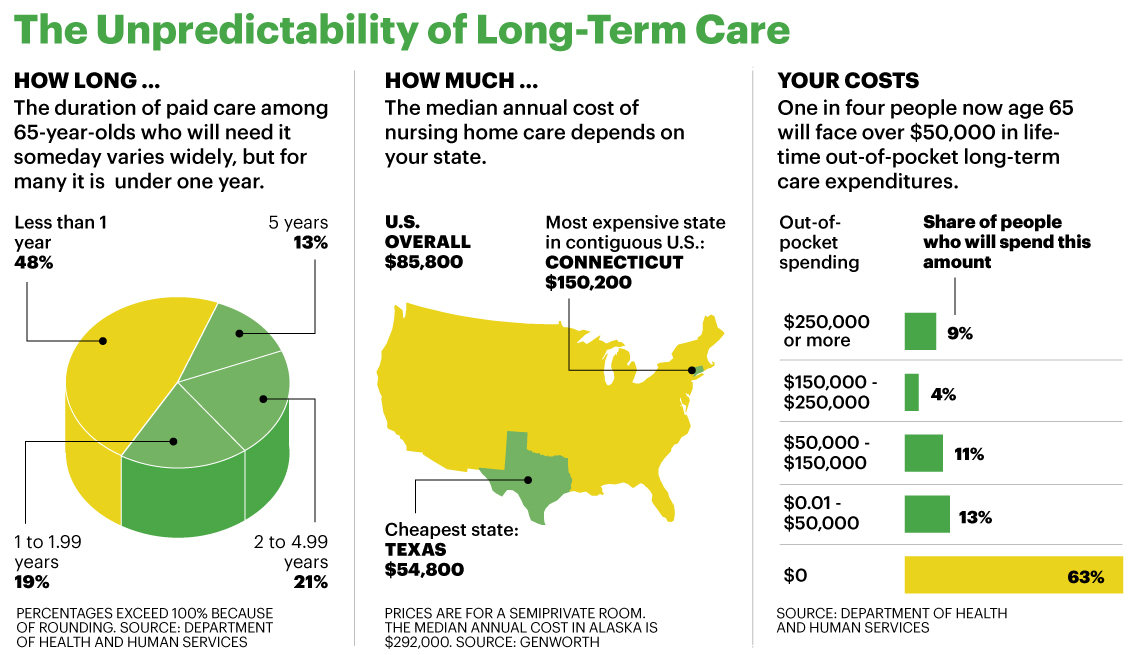

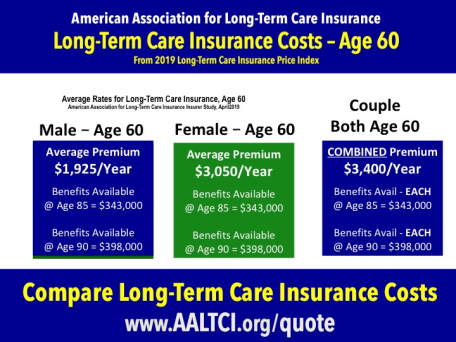

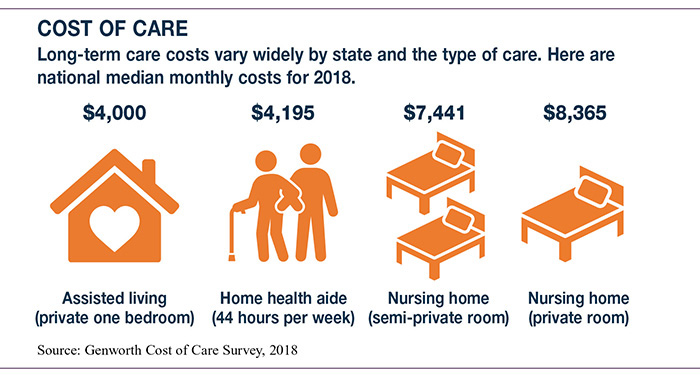

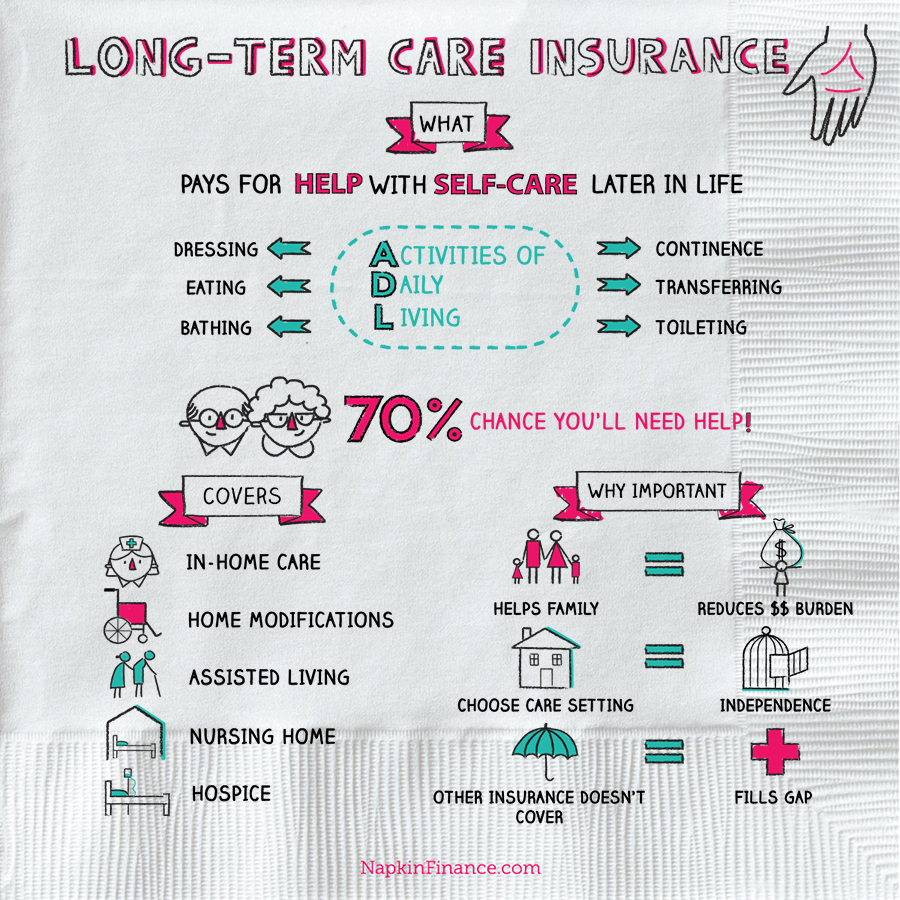

Insurance long term care. With most long term care insurance plans the elimination period the waiting period before a policyholder can receive benefits is generally 90 days. Covered care includes things such as visits from health and personal care aids and stays at assisted living facilities or nursing homes. In november 2016 former pensions minister ros altmann warned the government that britain was sleepwalking into a care crisis and on 15 december 2016 english. For years long term care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day to day activities such as bathing dressing and eating meals.

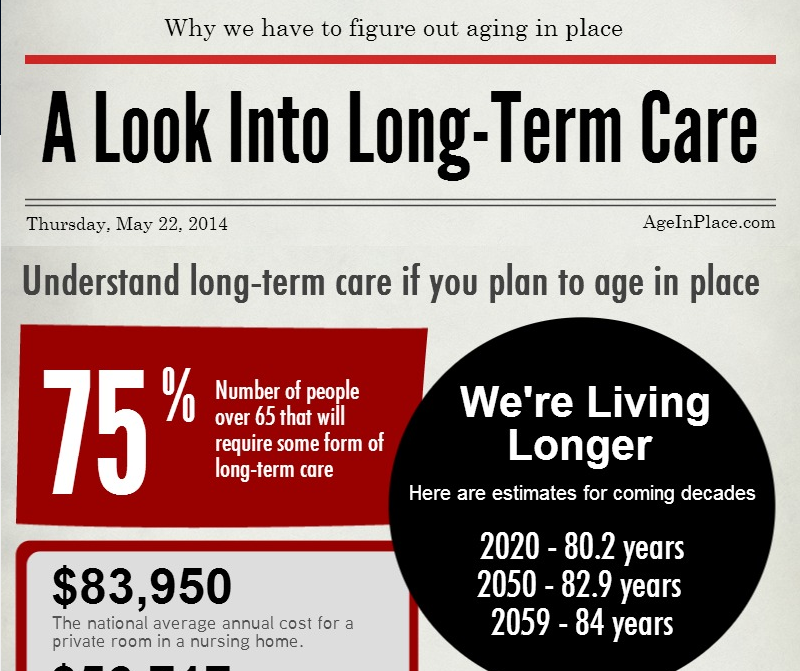

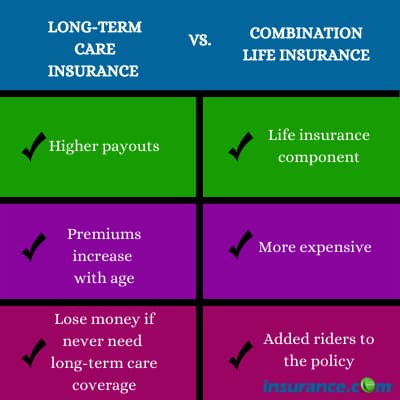

Younger people may consider purchasing critical illness insurance as an alternative to long term care when they are younger and in some cases the critical illness insurance provider may offer the option to convert the critical illness insurance into long term care when you are older in your 50s or 60s without taking a medical exam. A long term care insurance policy helps cover the costs of that care when you have a chronic medical condition a disability or a disorder such as alzheimer s disease. Long term care insurance policies reimburse policyholders a daily amount up to a pre selected limit for services to assist them with activities of. The issue of long term care is rarely out of the news and if you re searching for health insurance that ll protect you well into later life you might be struggling to find a policy that suits your needs.

Long term care insurance provides you with funds to pay for care if you ever need it. Long term care insurance ltc or ltci is an insurance product sold in the united states united kingdom and canada that helps pay for the costs associated with long term care long term care insurance covers care generally not covered by health insurance medicare or medicaid. Long term care benefits and inflation. Individuals who require long term care are generally not sick in the traditional sense but are unable to perform.

Long term care insurance covers things not normally covered by regular medical insurance. As its name implies massmutual is a nationwide mutual company that offers a wide range of life insurance long term care insurance retirement and investment products. Since many people purchase long term care insurance 10 20 or 30 years before receiving benefits inflation protection is an important option to consider. This includes nursing home assisted living or home care for those who need it due to chronic conditions.