Long Term Care Insurance Options

Short term care insurance covers the same types of care as long term care policies but for a shorter period of time three months to 360 days.

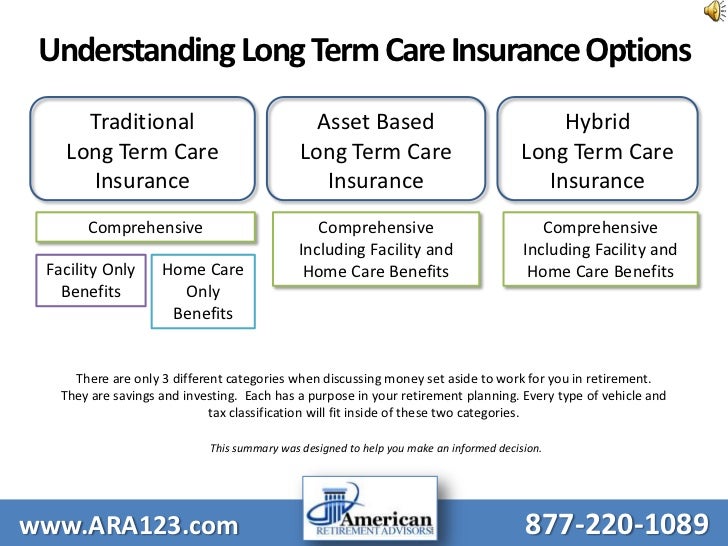

Long term care insurance options. Long term care insurance is a specific type of health insurance sold in the u s canada and the u k. You re the boss with a mutual of omaha long term care insurance policy. You choose the period when you buy. For years long term care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day to day activities such as bathing dressing and eating meals.

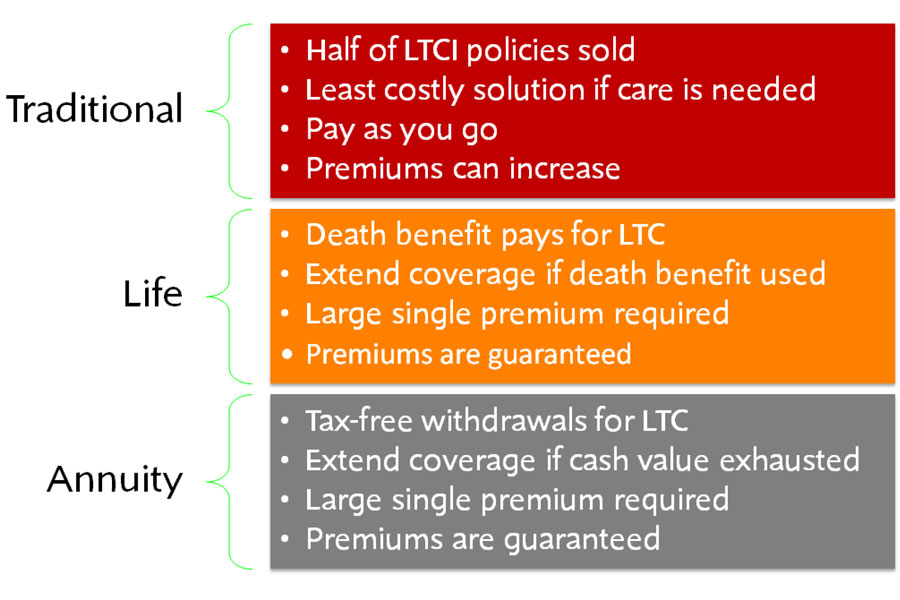

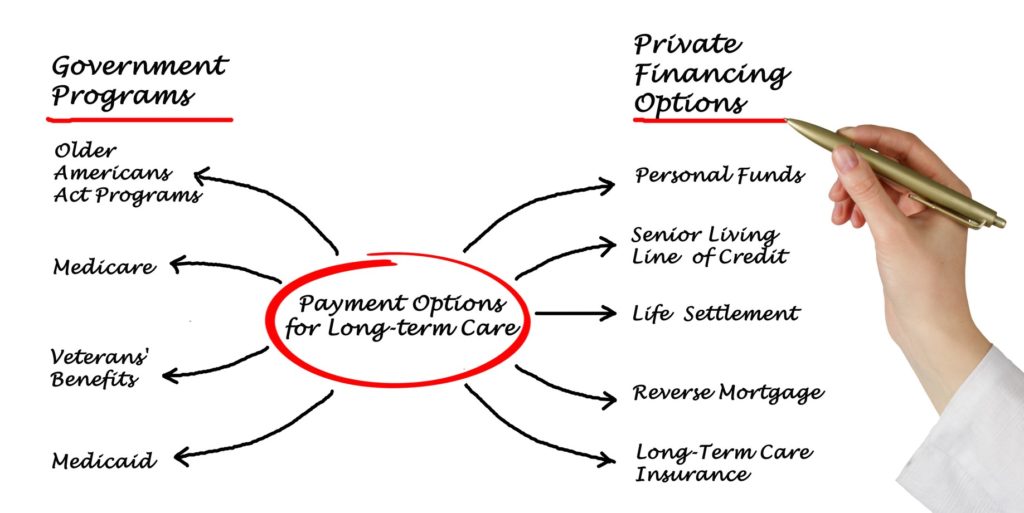

Typical terms today include a daily benefit of 160 for nursing home coverage a waiting period of about three months before insurance kicks in and a maximum of three years worth of coverage. If you find yourself priced out of the long term care insurance market or ineligible for health reasons there are other options to pay for long term care ranging from reverse mortgages to medicaid. Hybrid insurance which offers life insurance or annuity benefits with long term care coverage. Options to pay for long term care.

Design a policy to meet your needs with a wider choice of options than many competitors.