Long Term Care Insurance Premiums Deductible Self Employed

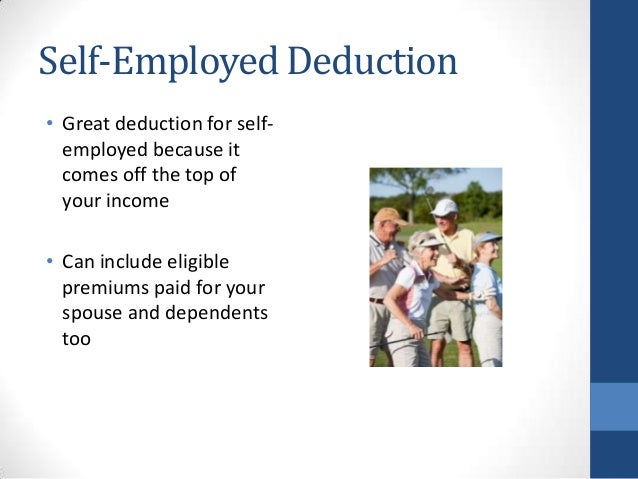

Self employed people who qualify are allowed to deduct 100 of their health insurance premiums including dental and long term care coverage for themselves their spouses and their dependents.

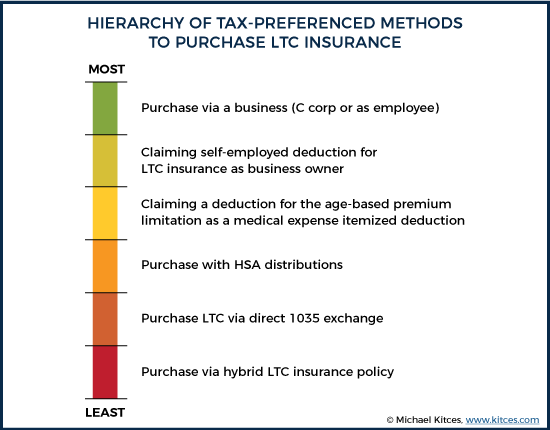

Long term care insurance premiums deductible self employed. The self employed may be able to deduct premiums paid for long term care insurance as an adjustment to income. You can deduct the premiums of traditional long term care insurance at 100 subject to the long term care deduction maximums. It s important to understand however that this is not a business deduction. Is your long term care insurance deductible if you re self employed.

Long term care insurance tax deduction for the self employed. If you qualify this deduction will reduce your adjusted gross income agi. Most self employed taxpayers can deduct health insurance premiums including age based premiums for long term care coverage. The entire cost of premiums paid for medical insurance dental insurance and long term care insurance are deductible for policies that cover you your spouse your dependents or adult children who have not reached the age 27 as of the last day of the tax year.

In addition to the long term care benefit there is a death benefit. The answer may surprise you. In a nutshell the self employed health insurance deduction allows eligible self employed folks to deduct up to 100 of health dental and long term care insurance premiums for themselves and for their spouses dependents and non dependent children under age 27. However if you are self employed you have a significant advantage.

As a result only premiums exceeding the 10 of agi threshold are deductible in 2019. Benefits like traditional long term care insurance come tax free. Read on to find out how you may be able to save money on your taxes as a self employed individual. Since these plans follow federal tax guidelines irc 7702 b a portion of the premium dedicated to long term care may be deductible.

/self-employment-health-insurance-deduction-3193015-final-c6496da4c8c64e838ee4875236d13c41.png)