Policy Bazaar Car Insurance Third Party

The working of a third party car insurance policy is quite simple.

Policy bazaar car insurance third party. Third party car insurance a third party policy is the most basic type of car insurance policy. Third party insurance is legally mandatory to ply your car on roads. The third party car insurance also known as third party liability insurance tpl is generally economical as compared to the comprehensive car insurance policy and covers all the damages caused to the third party by your vehicle. Third party car insurance online protects you from any 3rd party insurance claims arising out of death or bodily injury or damages to that person s property in an accident.

New premium for third party car insurance as per the new tariffs private car owners would have to pay premium subjected to the size of the vehicles. In this you the insured person are the first party the insurance company is the second party and the injured person claiming the damages in the third party. It provides coverage for third party liability as well as own damage. Comprehensive car insurance policies offer compensation for damage caused to the insured vehicle as well as the injury death of a third party.

Insure your car today with policybazaar car insurance and save upto 70. The insurance premium is computed on the basis of your insured declared value. This kind of car insurance policy has the lowest premium. Car insurance is of two types.

Third party insurance is the most fundamental and obligatory type of car insurance as per the uae rta law. Also called liability only insurance this plan covers the insured and the owner driver of the two wheeler against third party liabilities arising out of an accident which causes damage or loss to the third party or its property as well as death disability of the owner driver arising out of the accident. It covers the injuries caused to another person and his her damaged property. Third party insurance and comprehensive car insurance.

It s recommended to buy a comprehensive motor insurance plan. It takes care of all the expenses incurred due to unforeseen events such as theft accident mishaps and third party liability. The third party car insurance plan offers compensation for injury death of a third party as decided by a court of law and third party property damage up to rs 7 5 lakh. Rather than paying the damage repair expenses you pay an insurance premium to your insurance provider.

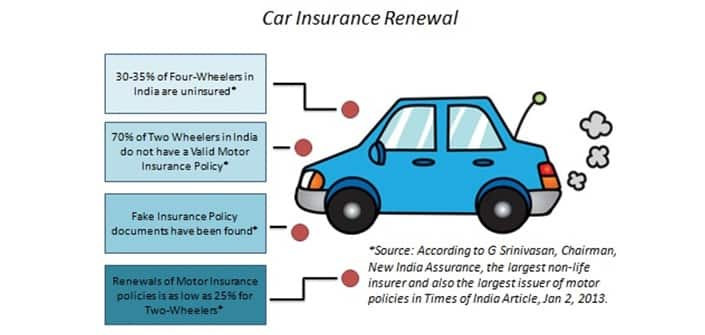

The third party car insurance cover is mandatory and controlled by insurance regulator and its tariffs are also controlled by it.