Royal Sundaram Car Insurance Zero Depreciation

Royal sundaram car insurance includes 11 unique add on covers some like no claim bonus ncb depreciation waiver etc.

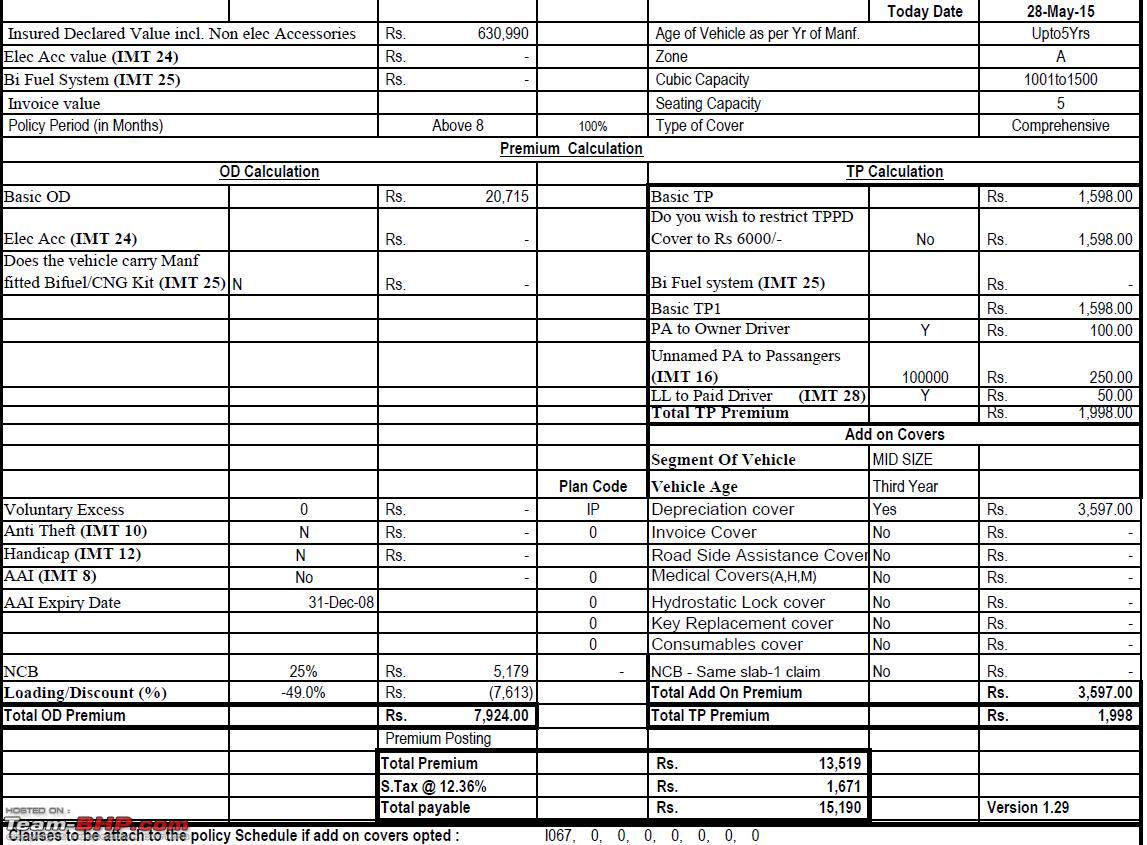

Royal sundaram car insurance zero depreciation. Royal sundaram zero depreciation add on. Zero depreciation car insurance. In a zero depreciation policy the insured gets the total cost of the damage or loss that is caused to the insured car. The depreciation value of the replaced or damaged parts is usually deducted at the time of claim but with zero dep policy one can claim the full amount.

Royal sundaram car insurance plans provides some of the unique features and benefits which caters to the requirements of the coverage of the car one of the most important asset in an individual s life. That enhance the protection offered in the standard policy. Vehicle is ford ecosport 1 5 titanium diesel 2015 march model. With zero depreciation add on when you file an insurance claim due to damage loss to your car the insurer covers the entire cost without accounting for counting in the vehicle s depreciation.

Get 100 invoice price insurance add on cover free rsa cashless facilities at 3 300 garages across india. When you buy a car insurance policy there is a condition with which you need to comply. Royal sundaram zero dep motor insurance or the new india assurance similar motor zero depreciation insurance. Zero deprecation is an attractive prospect for customers who want a smooth claim settlement in the future along with peace of mind.

Royal sundaram offers car shield that comes with 9 unique add on covers that offers an extra touch of protection at a minimal rate. Moreover royal sundaram car insurance plans are compulsory under the motor vehicles act as mandated by law. Car insurance quotes online available from royal sundaram in just 3 steps. Which is better and what are hidden or other facts in same.

Royal sundaram general insurance co. Is the first private sector general insurance company licensed by the insurance regulatory and development authority of india in october 2000. Besides the above mentioned inbuilt coverages royal sundaram car insurance policy also has optional riders which can be selected by paying an additional premium. Royal sundaram car insurance.

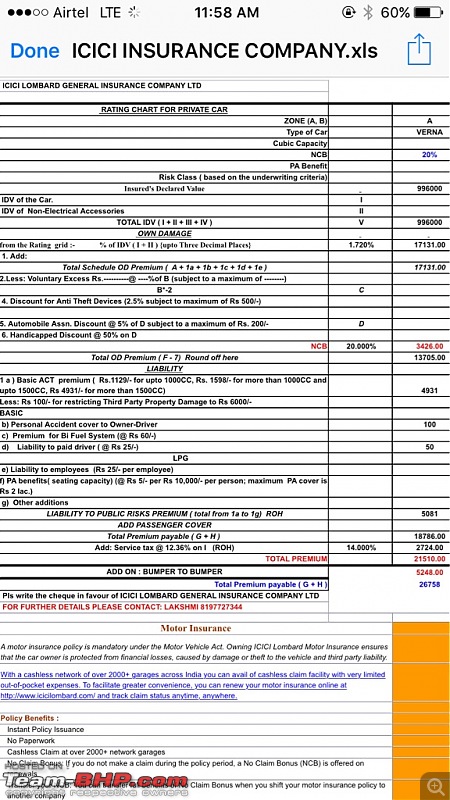

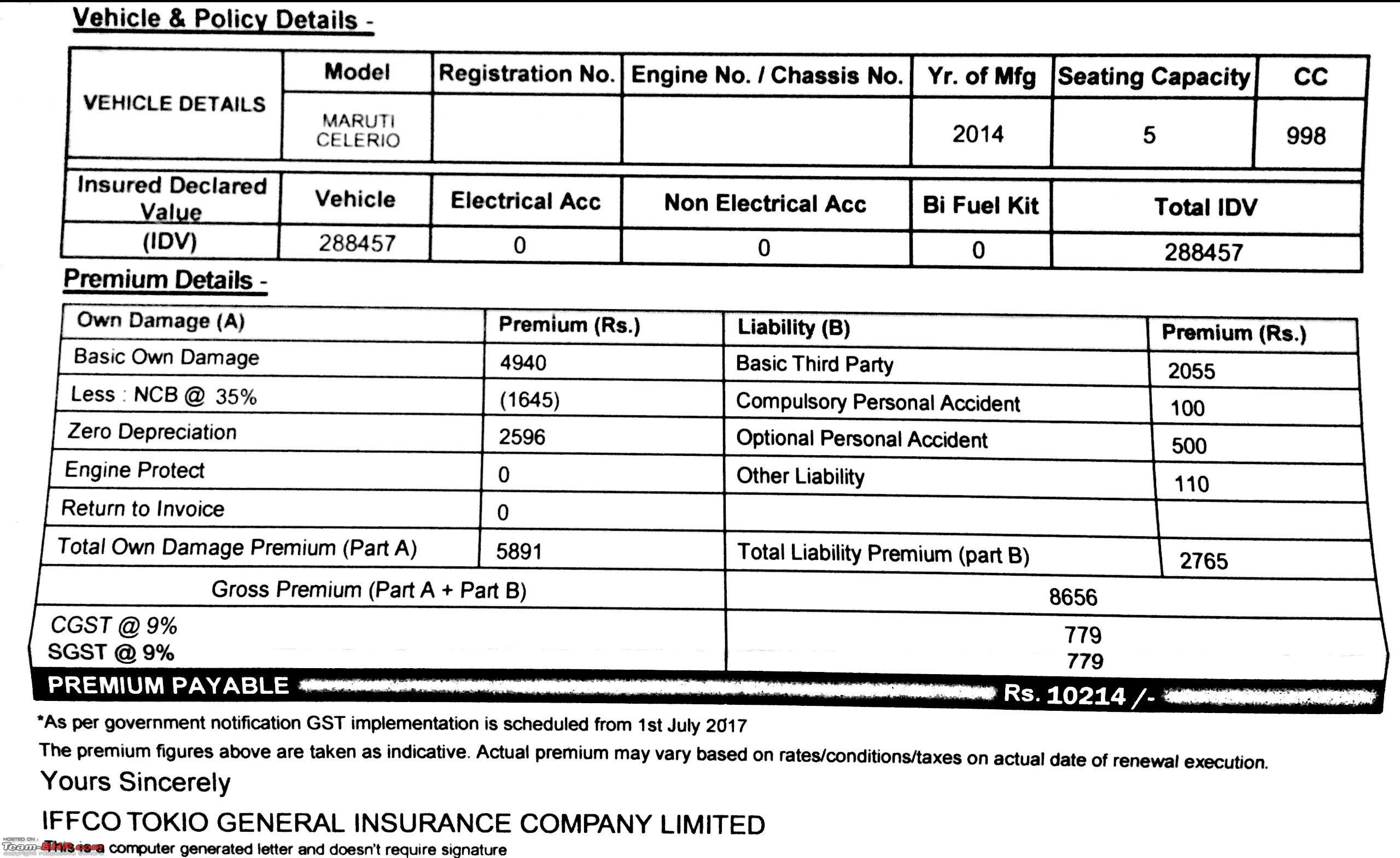

It is that the insurer will not bear the cost of depreciation while settling claims. For insurance it s third year renewal time. It is a joint venture between sundaram finance ageas insurance and other indian shareholders. 094444 48899 customer service.

.png)