Third Party Insurance For Car Price List In India

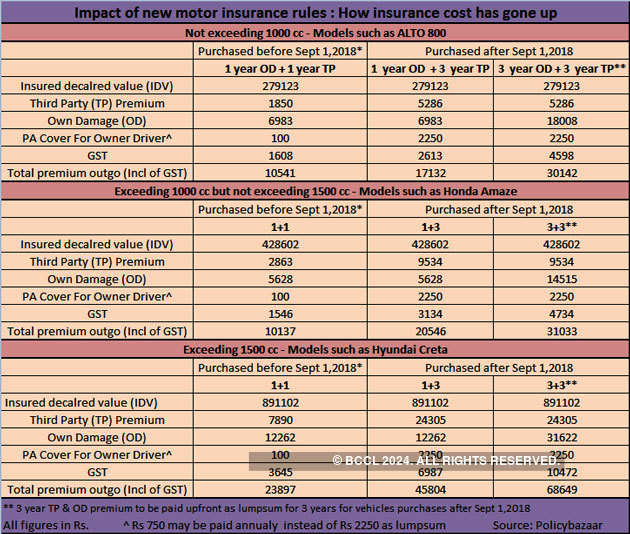

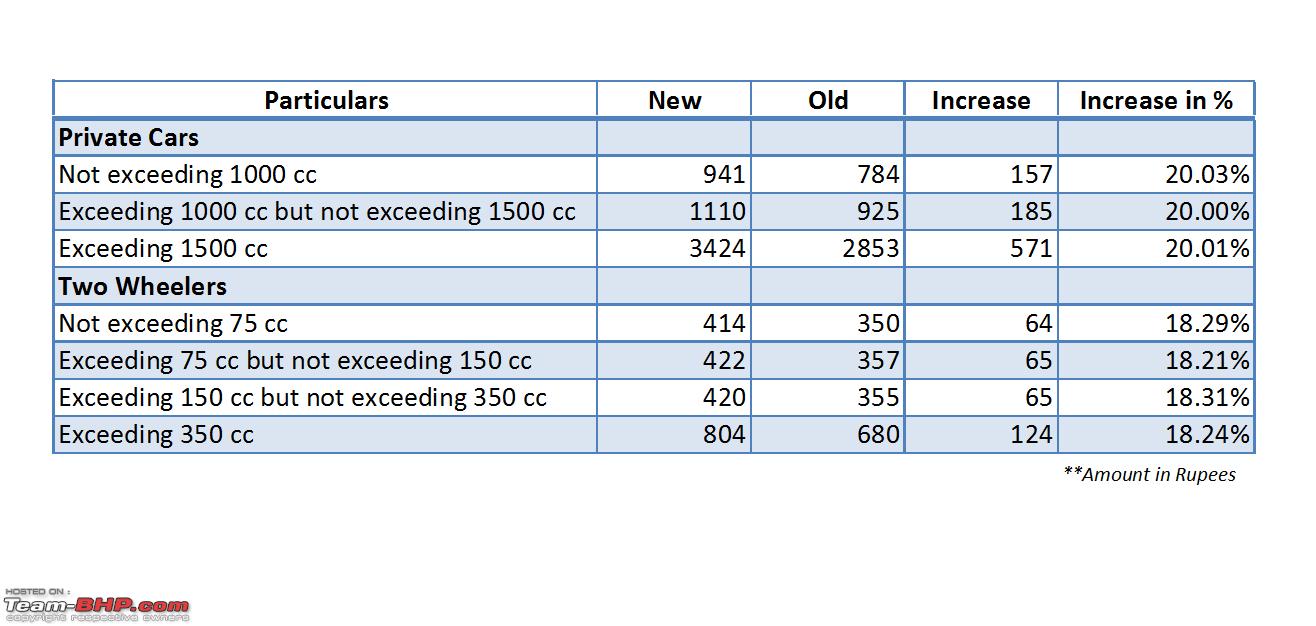

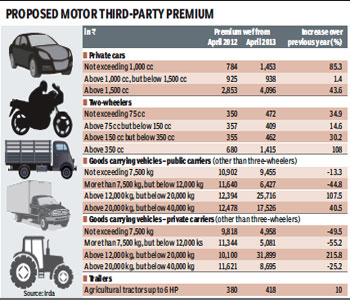

The regulator has proposed certain changes in premium for 2018 19 w e f 1 april 2018.

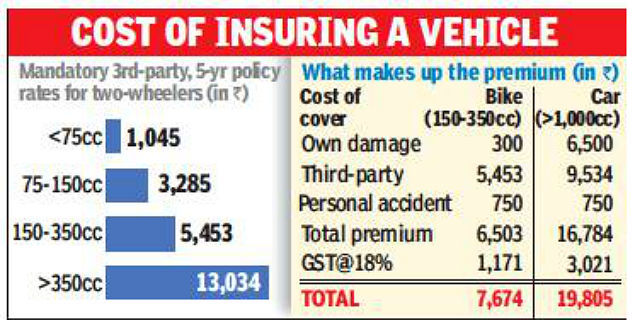

Third party insurance for car price list in india. Car insurance is of two types. Follow us on 7 th jun 2019 9 00 am. Third party insurance prices hiked. Third party insurance and comprehensive car insurance.

Again third party motor insurance online signing up for and or renewing existing policies is the latest technologically minded update in this insurance speciality. As per the motor vehicles amendment act 2019 the fine for the first offence of driving without insurance policy is rs 2 000 and or imprisonment of up to 3 months and for the second time offence of driving a vehicle without insurance policy then you will be liable to pay a fine of rs 4 000 and or imprisonment of up to 3 months. In india third party insurance for private cars is offered by all car insurers as it is mandatory and is usually an essential requirement when people seek out car insurance policies. The insurance regulatory and development authority of india irdai has.

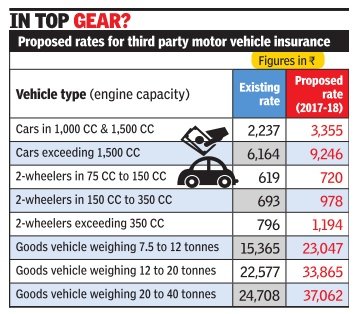

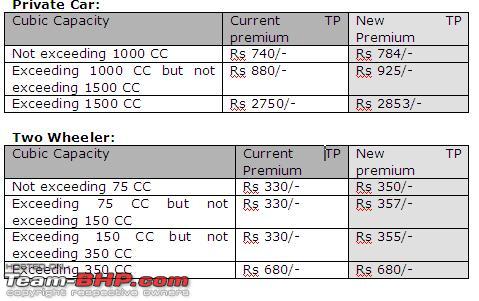

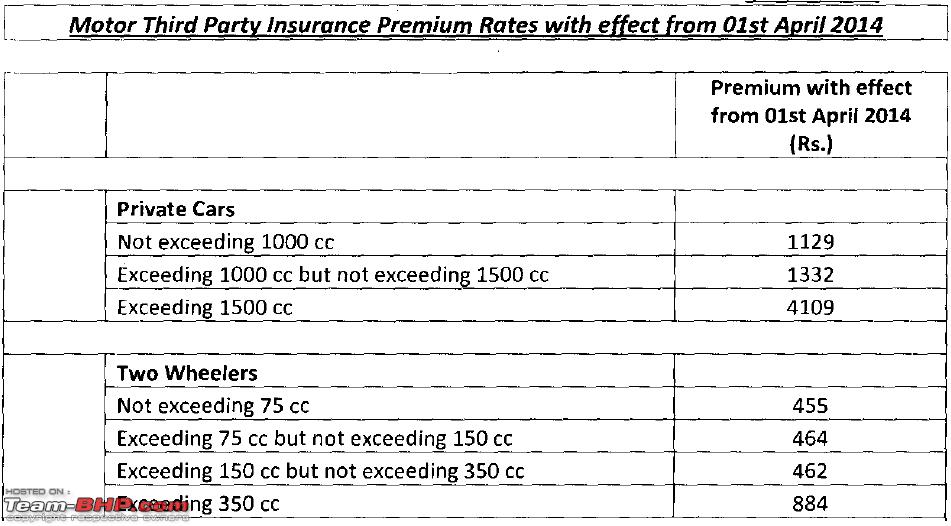

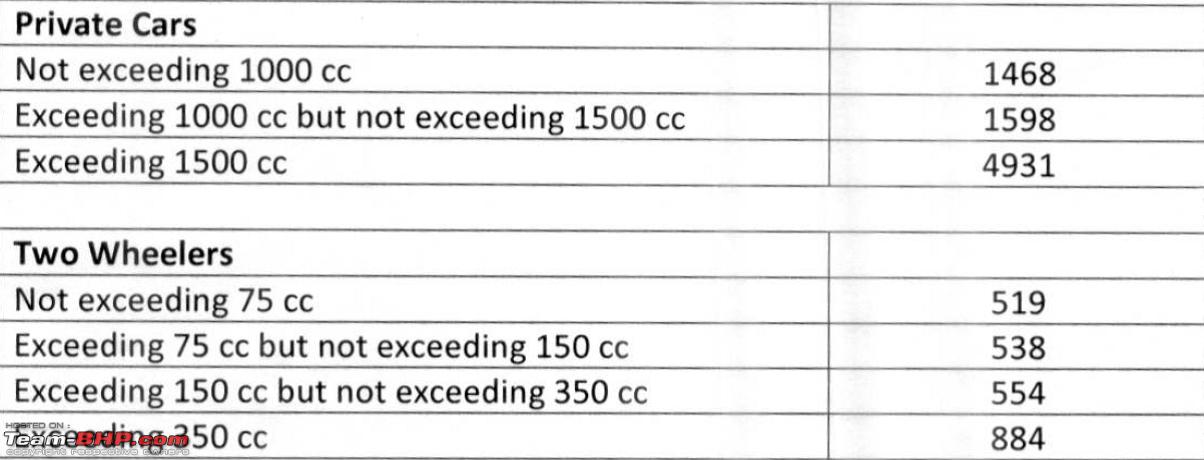

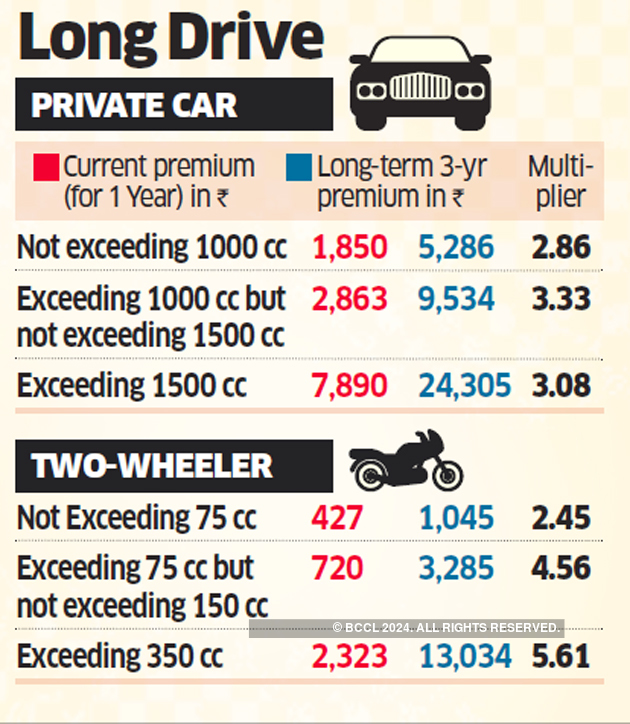

The irdai revises the third party premiums payable towards motor insurance plans on a yearly basis as per the claims registered and settled. You could soon pay more for your two wheeler and car third party liability covers this year. Third party liability car insurance price is a mandate in india under the motor vehicles act 1988. Third party insurance is legally mandatory to ply your car on roads.

Third party car insurance online protects you from any 3rd party insurance claims arising out of death or bodily injury or damages to that person s property in an accident. The insurance regulatory and development authority of india has proposed to increase private two wheeler and car third party liability rates by 4 21 for the financial year 2019 20 the highest percentage rise of over 21 will be seen in two wheelers with engine capacities between 150cc and 350cc.