Zero Depreciation Car Insurance Claim

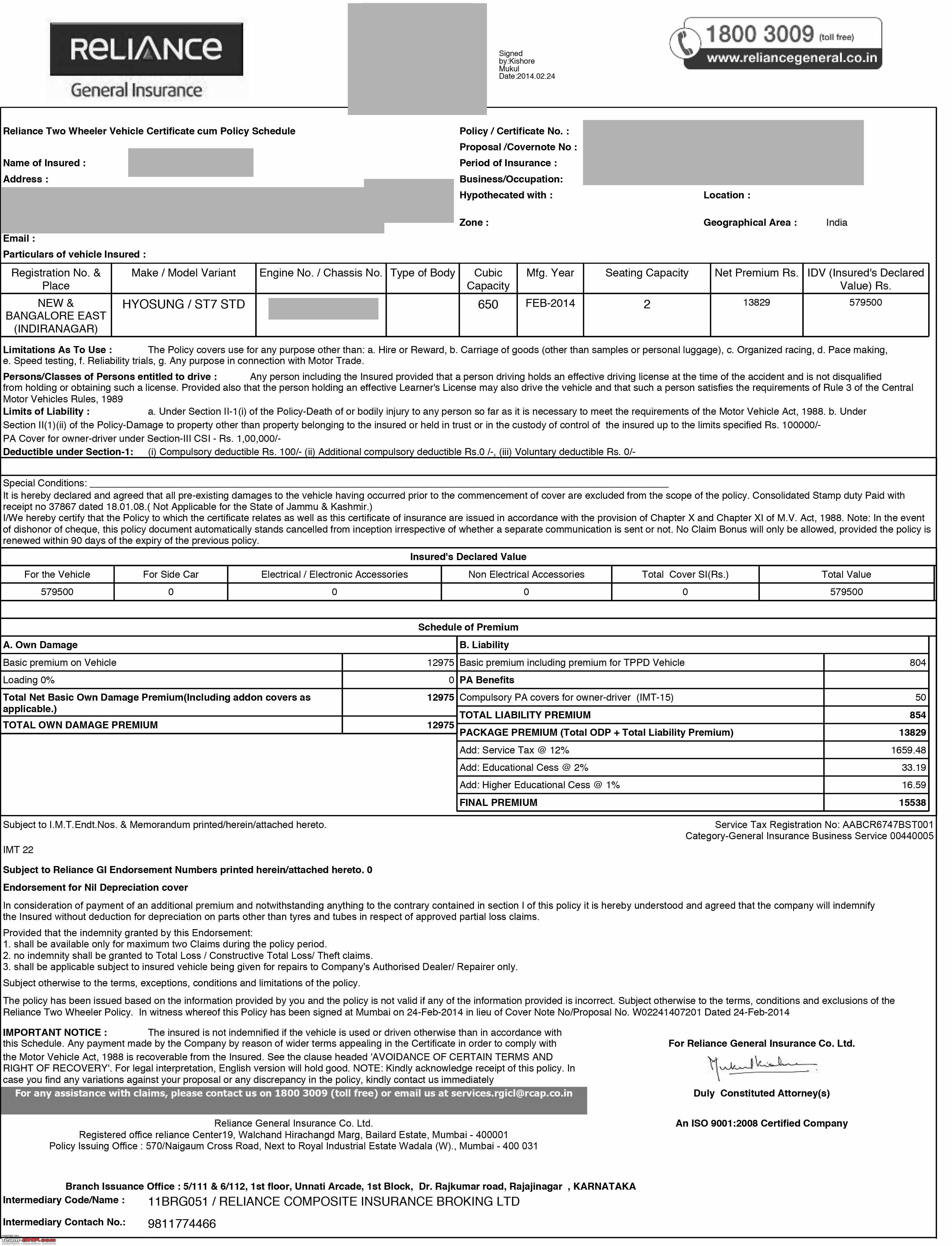

Icici lombard car insurance policy offers zero depreciation cover that is it provides coverage on replaced parts with no deduction for depreciation for the first two claims in a policy year.

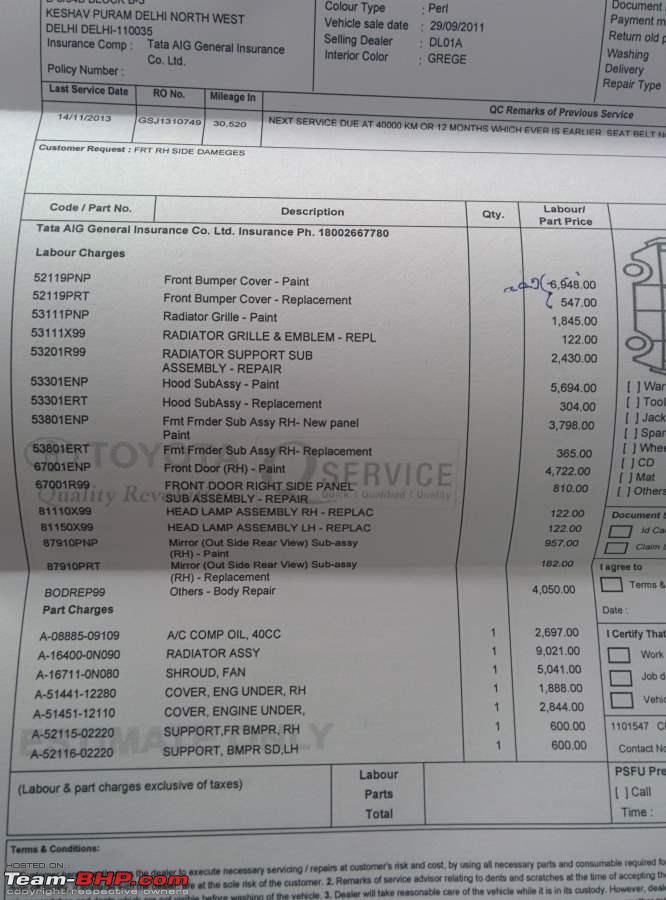

Zero depreciation car insurance claim. In a zero depreciation policy the insured gets the total cost of the damage or loss that is caused to the insured car. With zero depreciation add on when you file an insurance claim due to damage loss to your car the insurer covers the entire cost without accounting for counting in the vehicle s depreciation. Zero depreciation car insurance also known as nil depreciation cover offers complete cover without factoring in the depreciation. Zero depreciation car insurance.

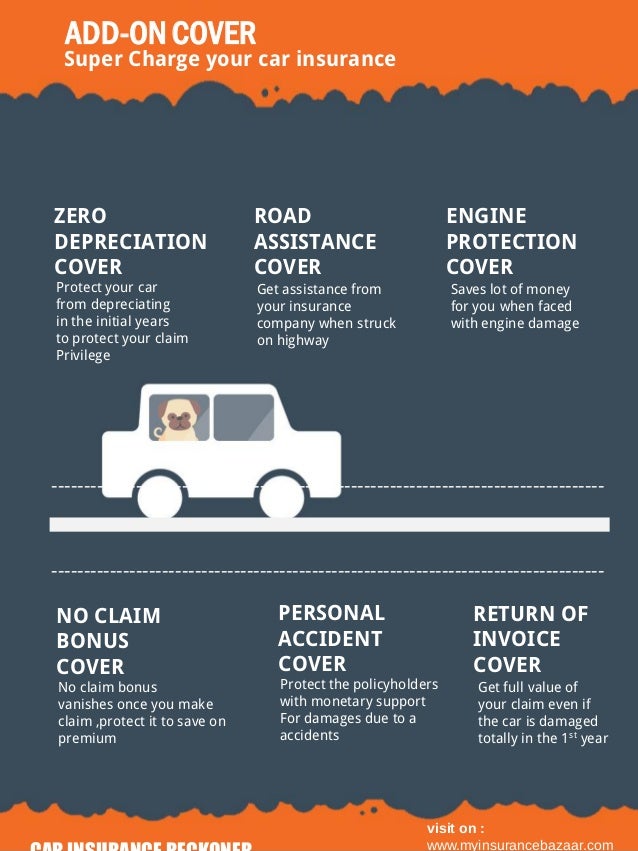

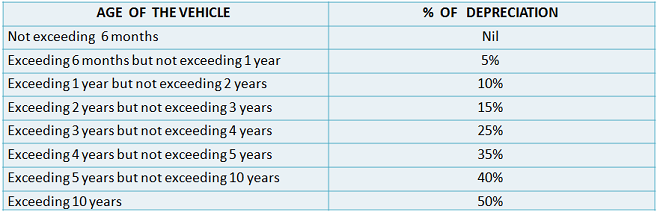

This means that the insurance company will factor the depreciation from the claim amount and you would receive a lesser claim amount. This insurance plan benefits the user in the case of an accident the user can claim for the full amount of the vehicle and the insurance company has to pay the entire claim amount without considering the depreciation value of the vehicle. The zero depreciation insurance cover is available only for vehicles that are less than three years of age. Zero depreciation or bumper to bumper cover is a car insurance policy add on.

This cover is highly beneficial for car owners as it ensures no deduction on account of depreciation for replaced parts in case of an accident. Thus if your car is damaged in a collision you will receive the entire cost from the insurer during claim settlement. The zero or nil depreciation add on acts like a shield against deducting depreciation of car parts while settling the claim especially while replacing expensive car parts. Claims on zero depreciation car insurance can be made in certain specific cases to limit the number of claims for minor issues like dents in the car.

Now you need to determine whether or not you need a zero depreciation rider with your car insurance policy. 50 depreciation is deductible on car batteries and parts of the car that are made of plastic rubber and nylon and 30 depreciation is deductible. With a zero depreciation car insurance policy the depreciation value is not taken into consideration hence the insurer will offer the entire amount of rs. However with the zero depreciation add on to your comprehensive car insurance depreciation does not impact the claim settlement and the insurer settles the entire compensation.

The depreciation value of the replaced or damaged parts is usually deducted at the time of claim but with zero dep policy one can claim the full amount. Zero deprecation is an attractive prospect for customers who want a smooth claim settlement in the future along with peace of mind.